The Group also exports its products to Moldova (1% in the sales structure with 2016 sales at the level of PLN 7,888 thousand) where sales fell by PLN 365 thousand. The largest player on the market is Supraten; the Group’s products also compete with products manufactured by Romanian companies. Other markets, which include Hungary, Romania, Slovakia and others, posted an increase of PLN 2,677 thousand (with total sales of PLN 11,993 thousand) as compared to the sales levels achieved in the previous year.

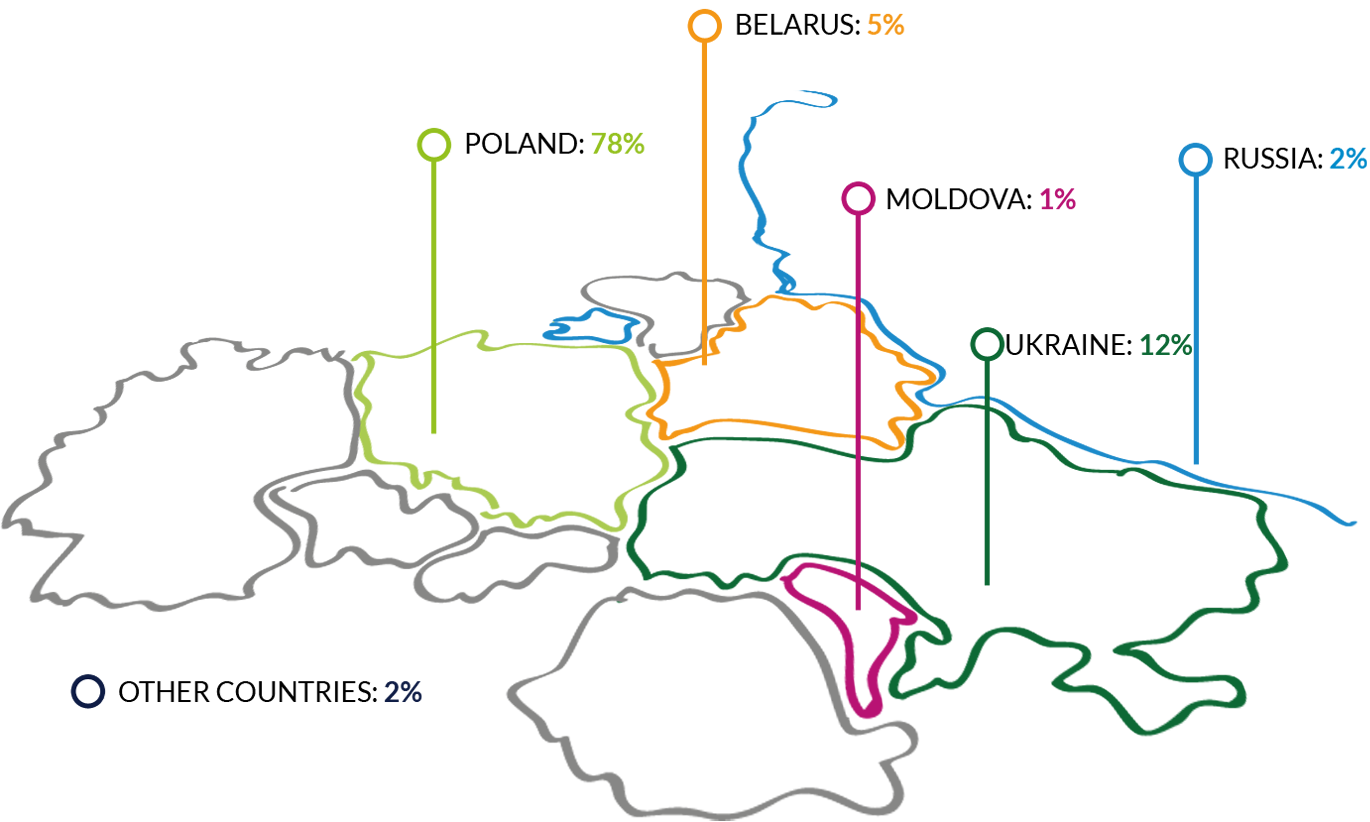

The Parent Company’s revenue posted in the reporting period is presented in the chart below.

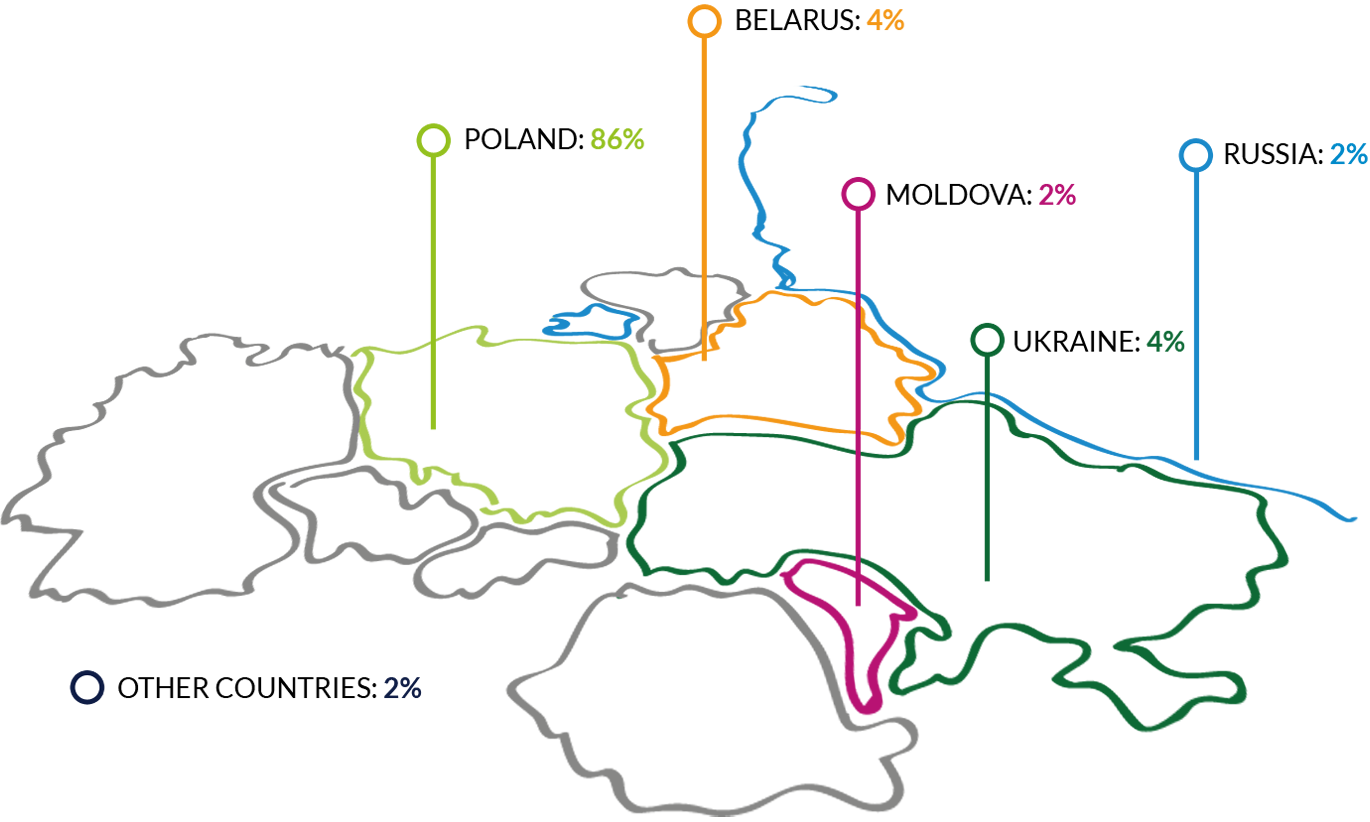

As it was the case for the Group, Poland was the leading market for the Parent Company, with an 86-percent share in the sales structure (up by 1 percentage point yoy). Other key countries where FFiL Śnieżka SA sells its products are Ukraine and Belarus. In the case of Ukraine, in 2016, the share in the sales structure was 4%, at the previous year’s level. The Parent Company’s revenue earned in Belarus also represent 4% of all the sales (down by 1 percentage point from the previous year.) Other markets (including Russia and Moldova) account for 6% of the Company’s total sales. In the reporting period, the Parent Company’s 2016 revenue on the Polish market reached PLN 445,887 thousand, which was PLN 20,609 thousand more than in the previous year. The Company’s 2016 sales on the Ukrainian market were PLN 21,900 thousand, up by PLN 408 thousand from the previous year.

In the reporting period, the Parent Company achieved PLN 20,084 thousand of sales on the Belarusian market, which was PLN 3,228 less than in the previous year.

Revenues on sales of FFiL Śnieżka SA products on the Russian market amounted to PLN 10,400 thousand, which was PLN 1,241 thousand more than in 2015.

The Parent Company also exports its products to Moldova (PLN 7,888 thousand of sales in the analyzed period) where sales fell by PLN 365 thousand. Other markets, which include Hungary, Romania, Slovakia and others, posted an increase of PLN 2,678 thousand (with total sales of PLN 11,993 thousand) as compared to the sales levels achieved in the previous year.

The Parent Company and the subsidiaries have signed agreements with all the distributors defining the terms and conditions of their trading cooperation. At the same time, the Group conducts actions to increase its share in other markets in which the individual Group companies operate, while seeking new directions for export sales.